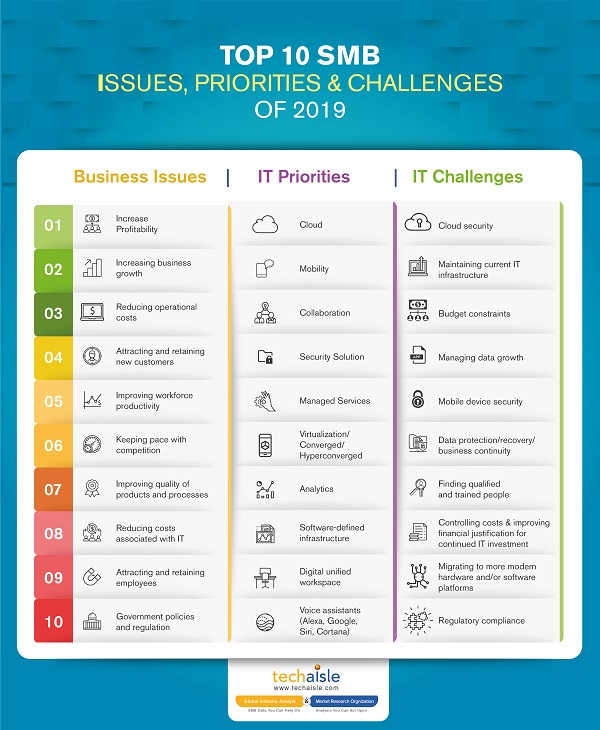

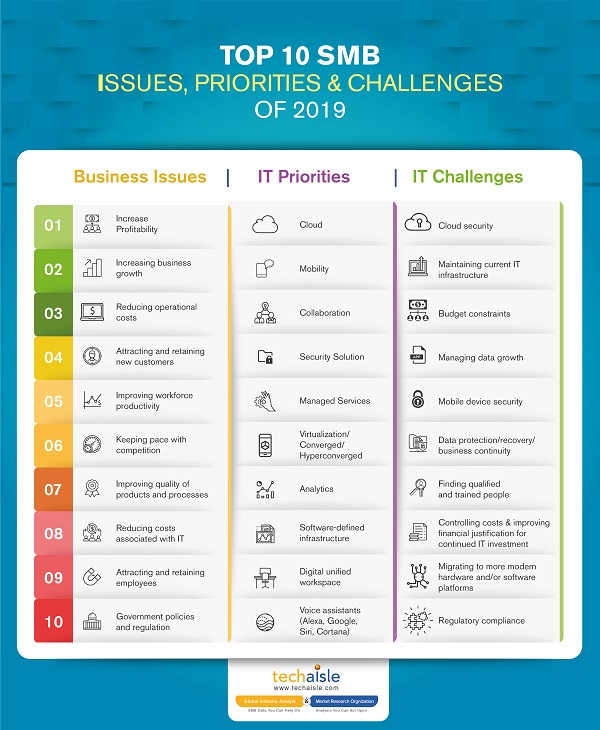

Techaisle has released its annual research infographics on top 10 IT priorities, business issues and IT challenges of SMBs (1-999 employees), midmarket firms (100-999 employees) and small businesses (1-99 employees) for 2019. In its detailed SMB survey Techaisle investigated 21 different technology areas and several technology sub-categories, 23 different IT challenges and 21 different business issues. This is the 9th year of Techaisle’s annual survey research initiative that probes for top business issues, IT priorities and IT challenges. Tracking history provides a fascinating evolution in which new business goals drive new IT priorities and uncover challenges that must be addressed to enable progress on business objectives.

Primary research was conducted among senior IT and business decision makers from Techaisle network of 1.2M B2B IT professionals spread across 30+ countries.

There are some interesting differences in IT priorities as compared to 2018. IoT and VR/AR fell below top 10 (but still within top 15) and replaced by Voice/Digital assistants as well as Open source solutions. Across all regions (US, Europe, Asia/Pacific, Latin America) digital unified workspace and software-defined are becoming a priority for both SMBs and midmarket firms. Security many places within the top 10 IT challenges in different forms – cloud security, mobile device security, data protection/recovery/business continuity – with Cloud security as the top IT challenge.

Global SMB & Midmarket IT spend (excluding telecom services) in 2019 is projected to be US$665B and corresponding cloud spend is expected to be US$115B. Research also found that IT budget growths in 2019 will be the highest in Asia/Pacific (6.2%) and lowest in Latin America (1.8%). While IT budget constraint is not the top challenge within SMBs in the US and Asia/Pacific, it is the top concern in Latin America.

Managing data growth is continuing to pose challenge for SMBs and when probed further Techaisle research found that only 11% of SMBs and 29% of midmarket firms have evidence-driven culture with data-driven decision-making business processes in which data defines requirements or opportunities and management then determines the best option for moving forward. In the US, 17% of small business and 34% of midmarket firms consider themselves to be innovative.

2019 Top 10 SMB business issues, IT priorities, IT challenges