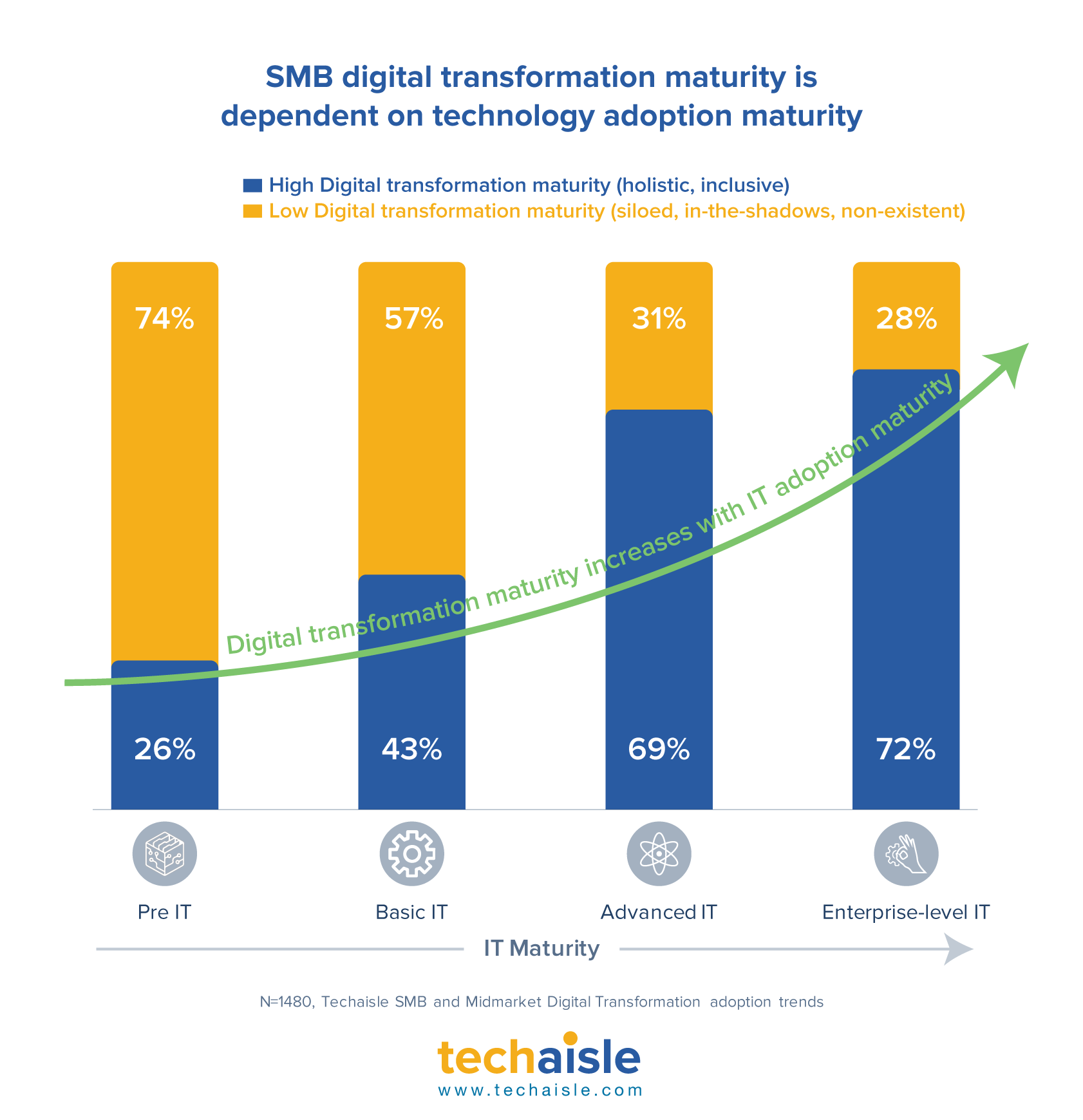

24% of small businesses, 52% of core midmarket firms, and 54% of upper midmarket firms are in the advanced IT maturity segments. Rapid and recent digital transformation has undoubtedly changed the IT maturity curves within the SMB market. Two years ago, only 16% of small businesses were in the advanced IT segment. 24% of firms are now in the Enterprise-level IT segment within the core midmarket, up from 14%. The enterprise-level IT SMB segment is growing at 1.5X that of Basic IT, and their IT spend is 1.4X of the Basic IT segment.

Employee size segments are not the only way of addressing the SMB market because the SMB market is not a monolith. SMB market consists of many segments, each of which has its unique approach to IT adoption. Suppliers who understand the scope and characteristics of these segments can expand their target markets and develop strategies geared to reaching high-potential SMB prospects. These suppliers ultimately have access to an expanded TAM and have the insight needed to align marketing investments with priority customers. The segmentation beyond employee sizes generates the most' run rate' revenue in the IT industry. When discussing IT industry growth opportunities, the focus often turns to earlier-stage technologies. Sellers of these technologies tend to focus on advanced segments (large accounts, particularly in leading-edge industries). They generally view SMBs as a secondary market, not realizing that SMBs and midmarket firms are full of opportunities. The Enterprise IT segment may focus on the same core issues that trouble its less-sophisticated peers but at a level of complexity that is very likely unique to this segment and similar to large enterprises. Enterprise IT is also the only segment that raises the challenge of connecting cloud and on-premise environments – an essential set in creating a hybrid IT environment.