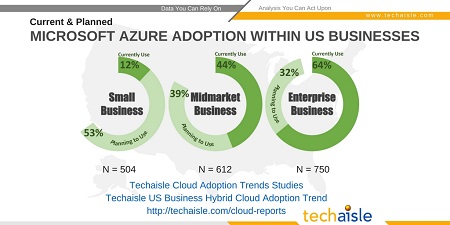

Techaisle’s detailed survey on Hybrid Cloud Adoption trends covering small, midmarket and enterprise firms shows that although Amazon AWS has established its initial presence within the US businesses, Microsoft Azure is quickly becoming the cloud platform of choice.

Microsoft Azure, a public cloud computing platform, is a growing collection of integrated cloud services that includes analytics, computing, database, mobile, networking, storage and web. Microsoft Azure initially focused strictly on PaaS but has now entered into IaaS market and launched a technical preview of Azure Stack, a platform designed to allow business to deploy an on-premise private cloud and manage a hybrid cloud environment. Microsoft Azure offers Hyper-V-virtualized multi-tenant compute with multi-tenant storage along with many additional IaaS and PaaS capabilities, including object storage and a CDN, Azure Marketplace which offers various third party software and services and Azure ExpressRoute that meets the colocation needs of various small and medium businesses.

The respondents for the survey were CIOs, CSOs, CTOs, VP of IT, Director of IT, Senior manager of IT as well as key business decision makers responsible or influential in adopting cloud platforms within their organizations.

Businesses cited many different reasons as to why Microsoft Azure is becoming a platform of choice.