Techaisle’s 2015 SMB and Midmarket Mobility Solutions Adoption study shows that the trend towards increased diversity and sophistication of mobile app portfolios within SMBs is driving a concurrent requirement for enterprise mobility management solutions capable of automating management, security and infrastructure associated with complex mobile portfolios.

Although much of the public debate around mobility involves hardware brands and feature sets and overall penetration rates and even BYOD (which is now passé), the real business benefit of mobility is delivered via applications that address specific task requirements within the business, and mobility management solutions that overlay the management and security structures needed to integrate these apps with corporate IT systems.

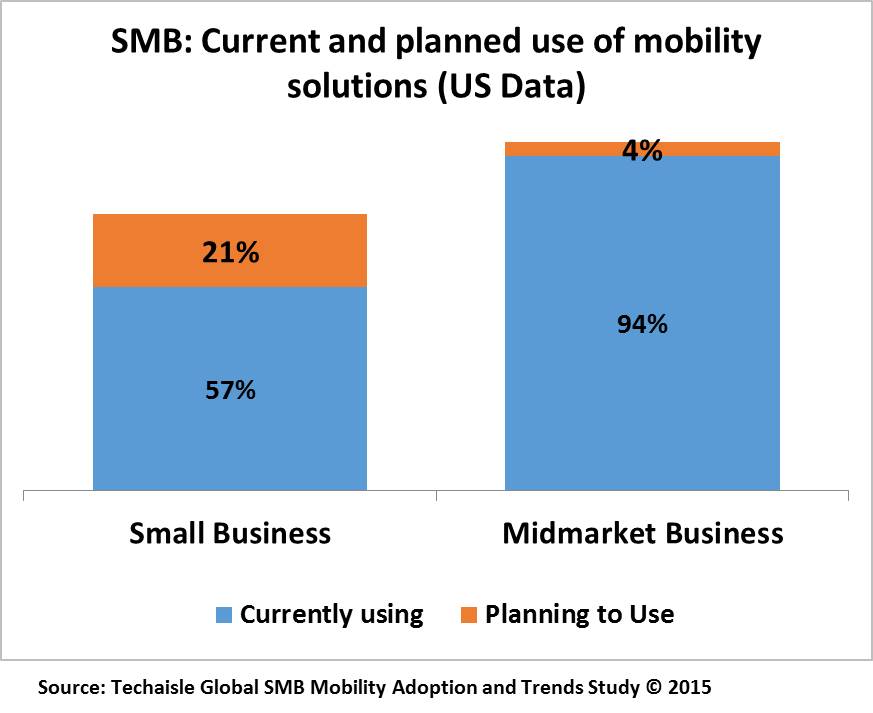

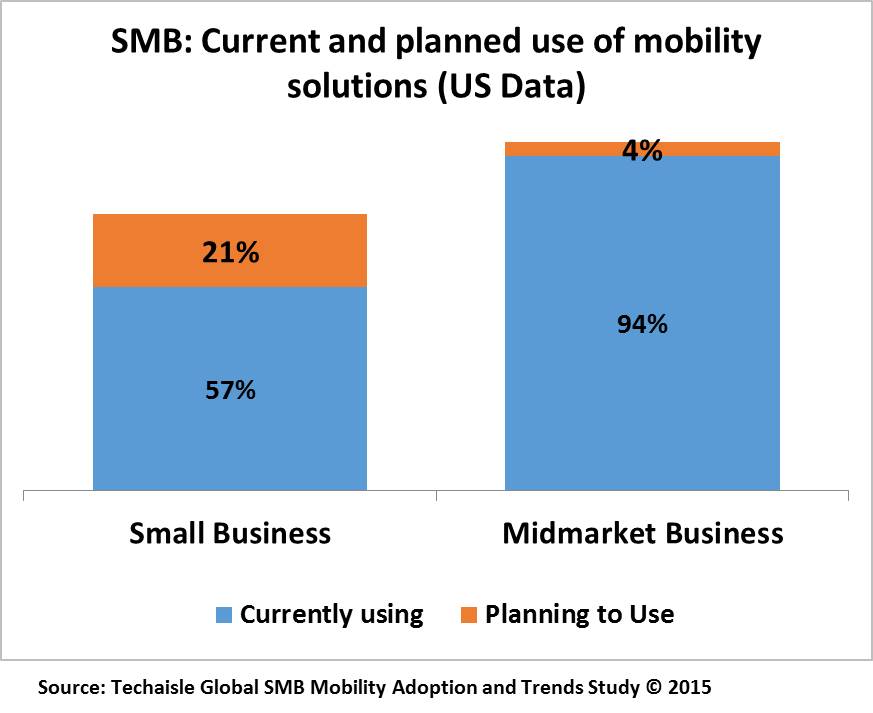

Figure below provides a snapshot of current and planned usage of mobility solutions. It shows that today, use of mobility solutions has crossed 50% in the small business segment, and that aggressive 2015 purchase plans – especially amongst 1-9 employee and 10-19 employee microbusinesses – will boost this figure closer to 80% in the near term. Initial penetration is nearly complete within midmarket enterprises, where well over 90% report current use of mobility solutions.

Focusing on Enterprise Mobility Management Solutions

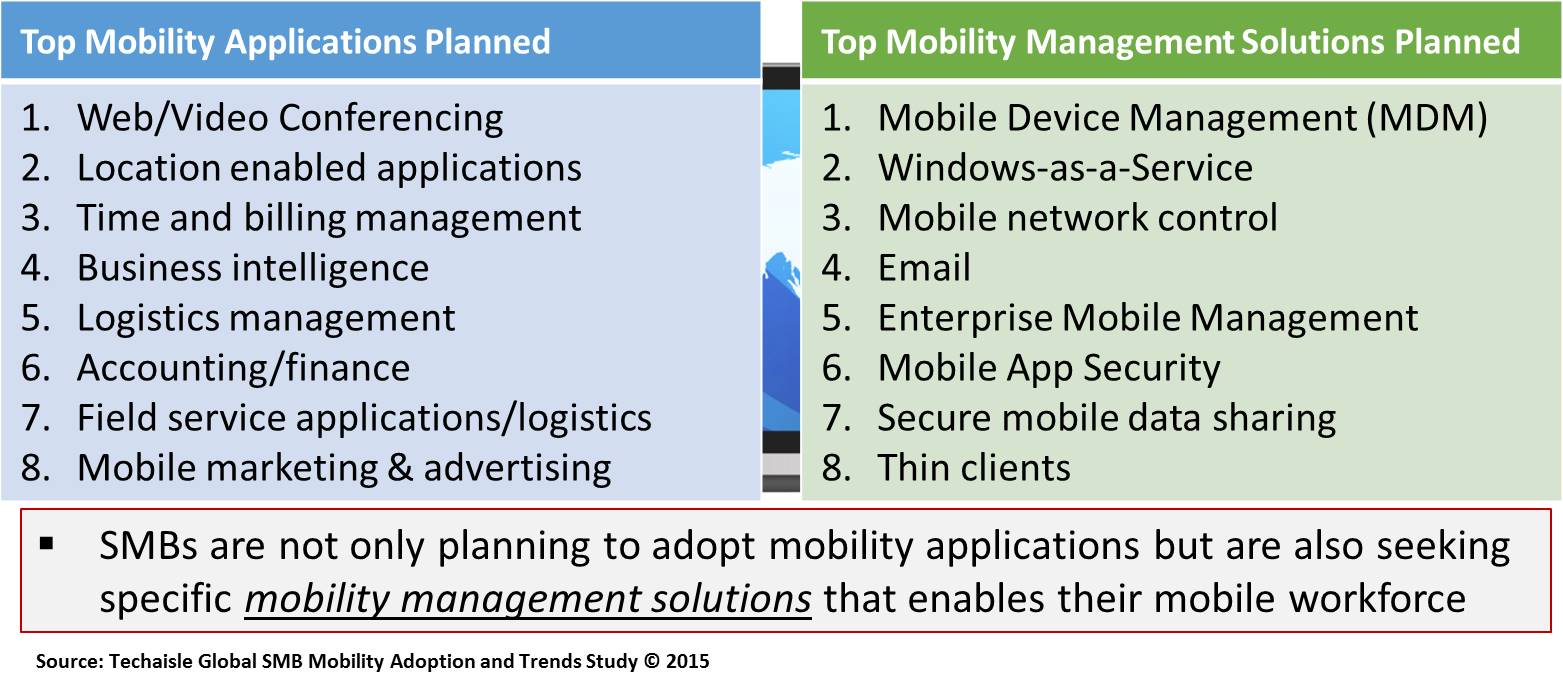

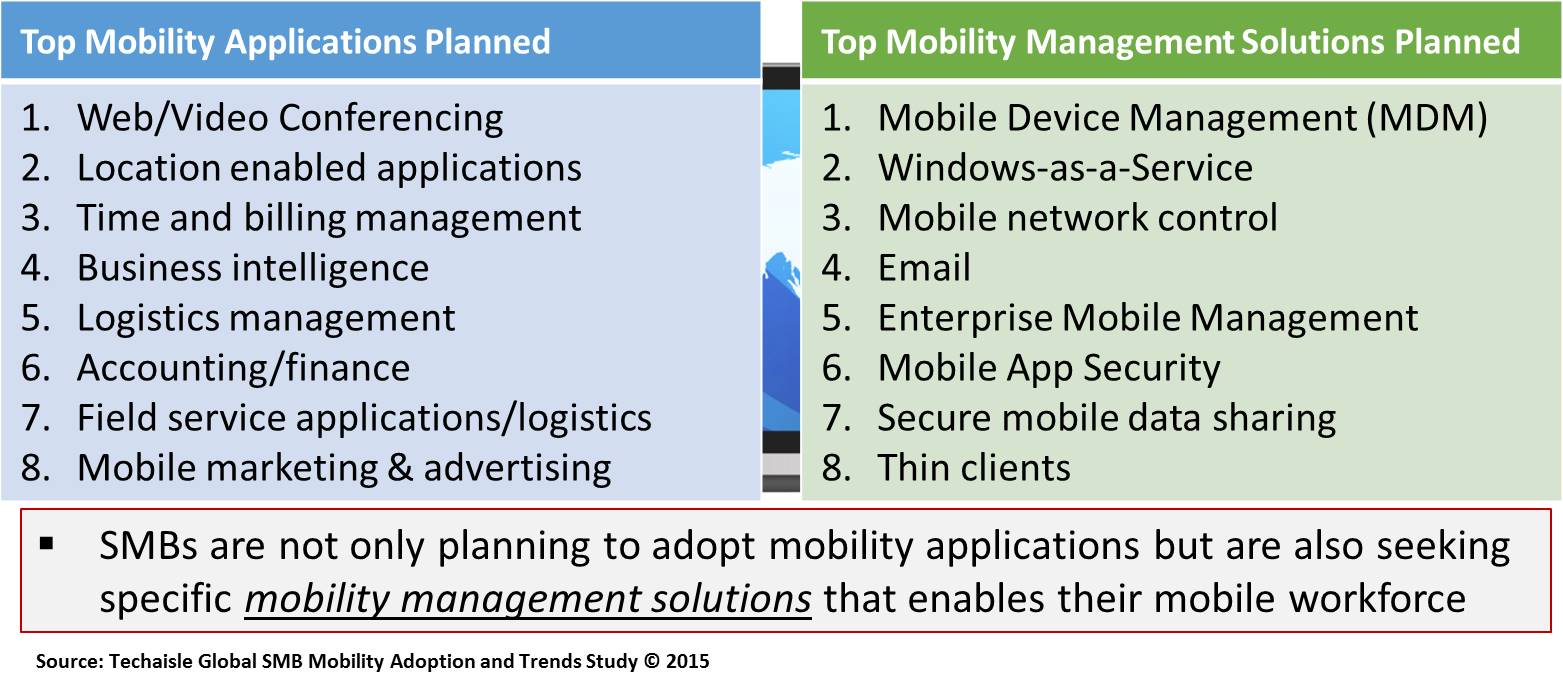

Consider the perspective included in the figure below. The left-hand text box includes eight mobility application categories predicted (by the Techaisle SMB 2015 Mobility survey) to have the greatest increase in adoption in the next one year. Half of the list is comprised of advanced applications: web/video conferencing (foundational), location-enabled applications and mobile marketing and advertising (emerging technologies) and business intelligence (second-order application). The SMB mobile application portfolio is both growing explosively and becoming more complex.

The right hand side of figure highlights the top mobility management solutions that SMBs are investing in to automate control of these sprawling assets. This list includes security solutions (MDM, mobile app security, secure mobile data sharing) that address widespread concern over the exposure that accompanies mobility, as well as methods of automating management (mobile network control, enterprise mobile management) and of deploying infrastructure tuned to the needs of mobile workers (Windows-as-a-Service, thin clients). Also included on this list is email, which is in the process of making the leap from an application that is accessed remotely to an integrated solution that connects seamlessly across environments and devices – a progression that will likely occur with other applications (especially foundational applications) over time.

This link between more sophisticated mobile deployments and the need to invest in mobility solutions to provide for management, security and infrastructure is apparent in survey data outlining SMB use of and investments in mobile solutions.

However, mobility management solutions are not a “set it and forget it” type of technology. These solutions require continuous tuning and ongoing investment as their scope expands to match the burgeoning requirements of an increasingly-complex mobile environment. Techaisle 2015 SMB Mobility study data also captured expenditure levels for mobility solutions by employee size. Comparing this data and connecting the dots with Techaisle’s other data on cloud, virtualization, managed services and analytics we find that mobility drives increased IT investment, especially amongst small businesses and as a market force, mobility “grows the pie” of IT spending in the overall SMB market.

Upcoming blogs on SMB Mobility:

- Mobility solution providers: not limited to traditional IT suppliers – VMware AirWatch, Citrix and IBM MaaS360 become important

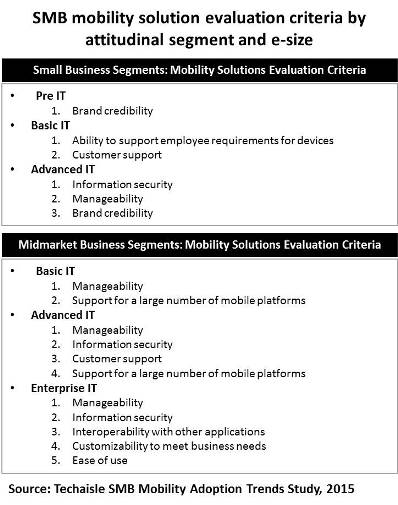

- What drives mobility solution supplier evaluation, especially in the midmarket?

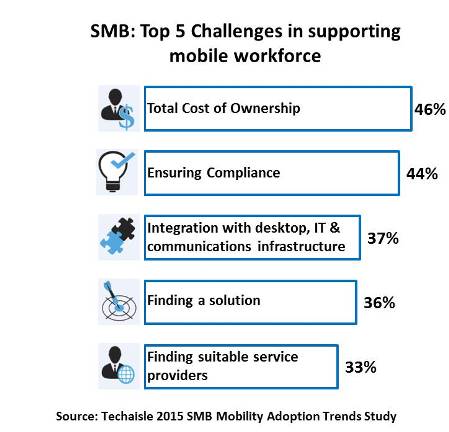

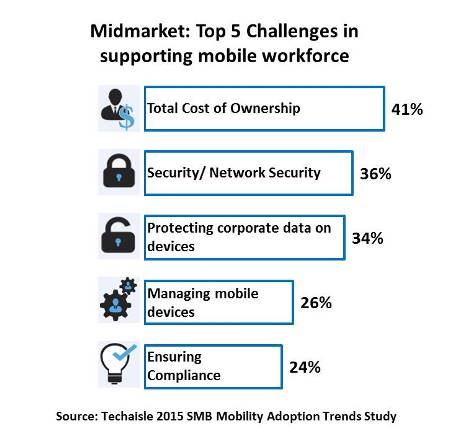

- What are the SMB IT challenges associated with mobile workforce support?