Dell was always been relevant for small business and education markets but is now in an exalted position to stake its claim within the enterprise segment and the new battleground – the midmarket firms. In this Techaisle Take analysis I cover Dell Technologies’ On Demand offering, Progress Made Real initiative, expanded PCaaS for SMBs, focus on customer advocacy, continued SMB investment, new converged infrastructure PowerOne, Unified workspace solution and channel partner strategy.

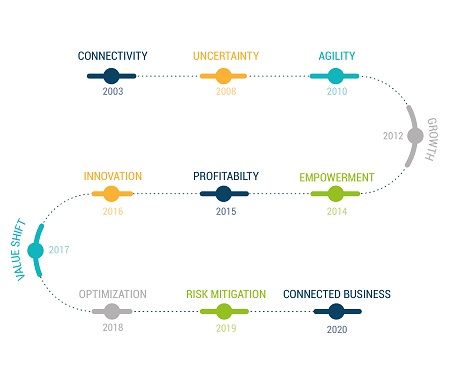

Dell Technologies Summit in Austin was a showcase of bold announcements and understated commitments to corporate social good and customer advocacy. Dell has certainly transformed in the last five years. It has moved along a path from a PC company to end-to-end solutions provider to a digital transformation partner to a place where it is driving its own transformation through the power of analytics with a goal of delivering customer success. Dell has catapulted itself into relevancy for the next decade.

In 1984, when Michael Dell founded his namesake company in his college dorm, I was a freshly minted engineering college graduate working through my first job at a tractor manufacturing plant in India. My first interaction with Dell was in early nineties when an India-based firm was awarded a contract manufacturing deal. I was then running the secretariat of a computer manufacturer’s association in India. Since then not only technology has progressed but both the consumers and commercial buyers have evolved. Dell has not only moved with the times but sometimes has been ahead of the curve. One such “ahead of the curve” initiative is “Progress Made Real for 2030” announced at the summit.

Progress Made Real for 2030 stands on four pillars:

- Advancing sustainability: for example, one-for-one recycling, that is, every product that Dell sells it will recycle an equivalent product

- Cultivating inclusion: committing to 50 percent of Dell workforce to comprise of women by 2030, 40 percent of managers of people will be women, 25 percent of US workforce will be Hispanic or African American

- Transforming lives: for example, Dell’s work with Tata Trusts, with a goal to reach 40m under-privileged people from the current 11m

- Upholding ethics and privacy

Enabled by a combination of pervasive use of technology and vastly-expanded solution options, the technology user and buyer community has become more diverse in both composition and focus. Business decision makers (BDMs) are not content to await IT’s blessing to pursue technology options that align with business needs: an increasingly tech-savvy business user/management community plays an ever-expanding role in assessing technology options, and even in specifying solutions and managing their rollout. At the same time, the solution options themselves have expanded to become more accessible to non-IT staff. Some technologies, such as analytics and IoT, directly address business management questions. Others, notably cloud, provide support and delivery options that give business units the option of avoiding IT oversight. Even core IT functions, such as storage management (especially with respect to Big Data) and security (particularly with regard to cloud and mobility) are reshaped by system requirements imposed by BDM needs. It is not out of place, as an analyst, to say that Dell has been a little late in recognizing and pursuing the shifting patterns. Regardless, Dell has been a believer of technology democratization and has begun a concerted effort to manage technology chaos with a differentiated customer strategy and drive the ability to scale human capacity. These are very lofty and moonshot initiatives. But then Dell is a founder-led company whose founder is skilled at assembling the proverbial ship piece-by-piece and navigating it through uncharted and occasionally choppy waters.

Dell Technologies differentiated customer strategy is built on four key points:

- Driving social impact with purpose-driven relationships

- Creating customer advocates for life by honoring customer loyalty and delivering success

- Making it easy to do business with Dell by executing on basics

- Unlocking customer value by leading with insights

Dell’s customer advocacy team is constantly analyzing 9.5K social conversations per day, looks at 33K customer verbatims in addition to its 16K sales team members sharing feedback. Dell’s plan to delivering a seamless and simplified customer experience is not very different from recently announced customer lifecycle experience, aka race track, by Cisco. End goals are the same, approaches are slightly different. But the fact that all suppliers are landing at the same end-state is significant on how the technology industry has evolved.

Perhaps the most important announcement at Dell Tech Summit was its On Demand offering. Dell went to great lengths to explain its genesis and development but it is clear that it a direct response to the growing popularity of HPE GreenLake. Regardless of HPE commanding the media-waves Dell has jumped headlong into the as-a-service, post-transactional market with Dell Technologies On Demand Autonomous Infrastructure available via DT Cloud. Dell is prepared to deliver solutions today and at scale. And it is also within reach of midmarket businesses. Key takeaways of Dell’s On Demand solutions are:

- On-demand, consumption-based and as-a-service solutions for on-prem infrastructure / services is customizable, integrated across the full-stack for Dell's end-to-end portfolio from edge to core to cloud

- Dell widened the product of their Flex On Demand offerings for PowerEdge servers and their new PowerOne autonomous converged infrastructure solution (announced at Dell Technologies Summit). With this announcement, Dell’s consumption-based on-demand solutions now cover PCs, servers, storage, CI/HCI, IoT, datacenters, networking and data protection. Ideally applicable for firms with a minimum $250K 3-year contract-value but end-points including PCaaS is available for SMBs (at lower committed contract values).

- Dell knows how to create simplicity within complexity. Businesses can customize and select their on-demand path from:

- Payment: Pay As You Grow, Flex On Demand, Data Center Utility

- Services: ProSupport, ProDeploy, Managed services

- Portfolio: Edge, Endpoint, Core, Cloud

- On Demand offering provides two options for channel partners to participate:

- Referral fee – 7%-10% on committed contract value including tier credit program benefit. Dell owns and manages the customer. The partner still plays an active role in managing the customer relationship. The referral fee model positions the partner to address the customer’s solution needs, and enhance their customer relationship without having to take on the usage and credit risk associated with offering a pay for use solution.

- Resell – Partner owns and manages the customer. Allows partner to uplift base usage charge and earn program benefits including rebates, marketing development funds, and tier credit

Pay As You Grow is for committed workloads. The metering coverage in Flex On Demand includes processor, memory, and GB consumed. Data Center Utility adds metering based on VM and per port. The solution is still in its early stages and Dell views this as a journey rather than a destination. But the offering, in early stages, is finding acceptance at many of Dell’s customers. Scalar (a CDW company) has been configuring on-demand solutions with unlimited scalability for major Hollywood studios.

Relative to the cost of conventional hardware and software, on-demand cloud solutions are generally more cost effective than equivalent CAPEX-based on-premise alternatives, and its OPEX-based billing model works well for cash-constrained SMBs and midmarket firms. Cloud’s ‘as-a-Service’ delivery model reduces the need for individual SMBs and midmarket firms to attract and retain specialized IT staff; scale up as the organization grows, and cloud provides SMBs and midmarket firms that are often unable to maintain refresh cycles with ‘always-on’ access to current technology.

SMBs are not being left out from Dell’s strategy. In fact, small and midmarket businesses are two of the fastest growing segments for Dell. Its small business advisory has witnessed tremendous success but the team is not resting on its laurels. It aims to add 100 more small business advisors in the next one year. Each advisor goes through 160 hours of in-person classroom training. Dell has built a progressive hierarchical advisory structure, based on “needs complexity” to help SMBs learn, identify, buy and deploy technology. Small businesses with specific and simple requirements can also use Eva – a chatbot – to help guide through product selection and purchase.