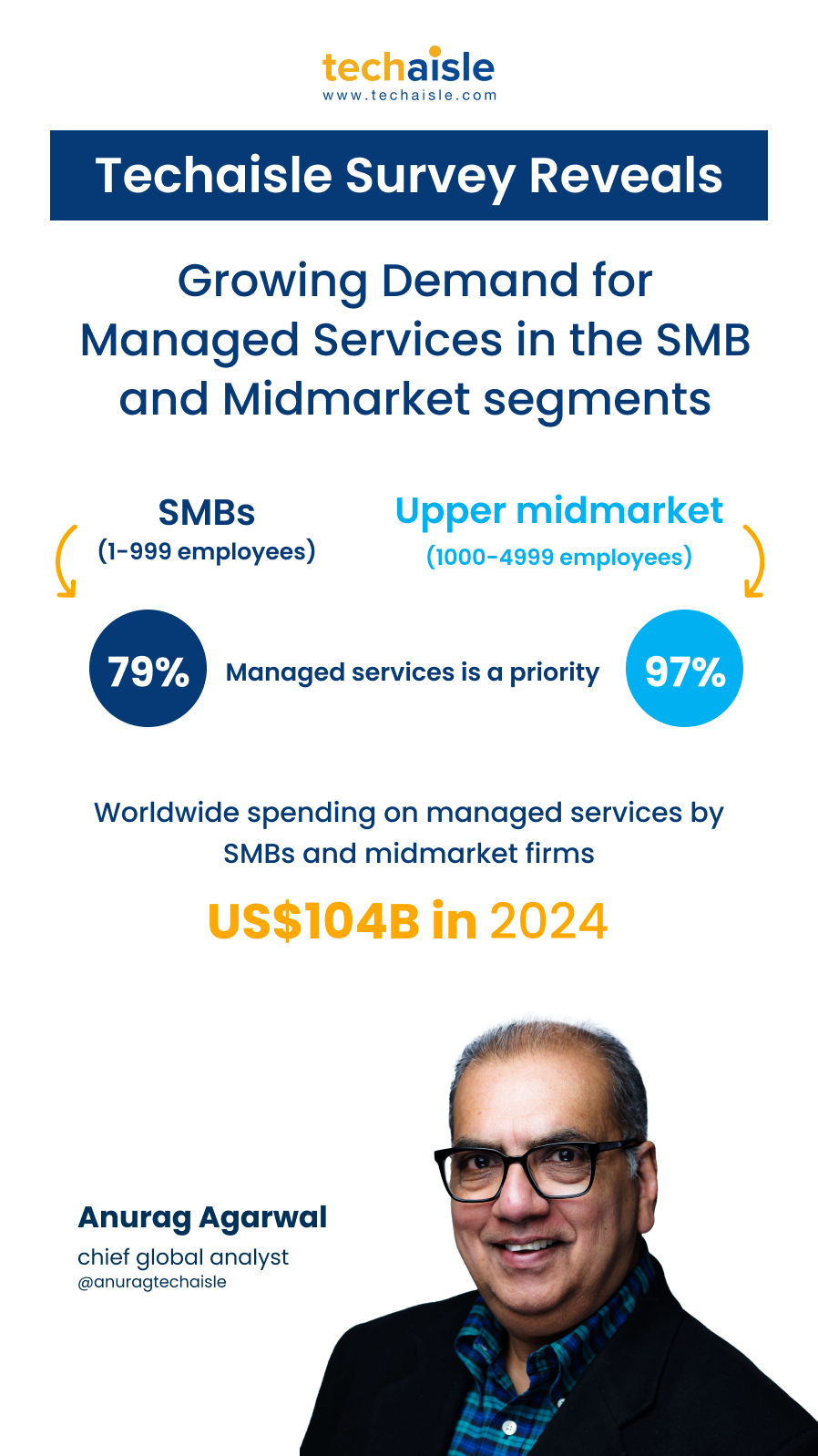

A Techaisle SMB and Midmarket adoption trends study of over 5100 SMBs and midmarket firms found that managed services are a priority for 79% of SMBs and 97% of upper midmarket firms. Worldwide spending on managed services by SMBs and midmarket firms is estimated to reach US$104B in 2024. Data from the last five years also shows an increasing overlap between managed and cloud consulting services, with a growing need for cloud cost optimization, security and compliance, and cloud and storage optimization. In the final analysis, Techaisle expects strong growth for managed services as it directly supports critical business and IT needs.

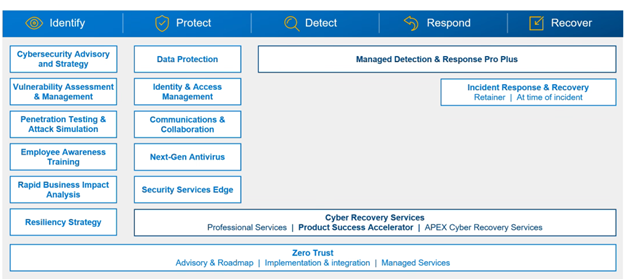

The adoption of managed services is driven by several key factors. These include improving IT security and management processes, proactively identifying and fixing problems, reducing IT and business risks, and enhancing disaster recovery and business continuity readiness. However, the focus of demand for managed services is shifting from infrastructure management to areas such as core security and application management, business process automation, cloud management, analytics, AI, edge and observability management.